This is something I wrote a couple of years ago, when I started to understand that the financial market had gone wildly astray. I’ve been tinkering at it since and I’m still not happy with it but I need to post it as a stepping stone for what I’m going to publish next.

Money appeared, at first, as a trade facilitator: instead of changing five measures of grain for one of oil people started to use as an intermediary step of the process whatever the local civilization called “money”. From shells to beads to holed pebbles or whatever else.

Then some people wanted to delay consumption, stock up for “black days”, or wanted to trade further apart. That was when they “invented” gold.

It was not only generally accepted, relatively easy to divide without sizable loses but also practically indestructible. This was fine from the monetary point of view but also created the illusion that gold (and later money) was the supreme value per-se. Everybody ‘forgot’ that things have ‘value’ only as long as people have a use for them. The simple fact that there is no such thing as ‘value’ but that which we – buyer and seller, attach to each object when it passes through our hands.

Do you remember the alchemists trying to transform everything into gold? What if they succeeded? Probably we would have roofed our houses with some very cheap and everlasting gold shingles.

Since it was indestructible it created another illusion: that its role/value will last forever. And so, for some two thousand years, until let’s say 1100 AD, gold, as money, played its roles as trade facilitator and hoarding device.

Until then resources available to the society had been allocated at the discretion (whim?) of the local ruler (the “strongest” guy around). Who later used to pretend he had a divine blessing to decide the fate of the commoners. For example the feudal system consecrated that the king ruled who had the use of what piece of land or of whatever other natural resource.

An old habit had resurfaced at the same time. Civilizations restarted to trade goods and ideas between them. (Christian and Islamic around the Mediterranean Sea, for example). The advent of new transportation technologies created new opportunities for travel and trading. This was when a quantity of gold (money) became itself a resource, albeit not a natural one.

You could use it to start a trading cycle yourself. Or you could “rent” it to somebody else, for a fee. The interest. That way, somebody else – the ‘renter’ of capital, could do the actual buying, transporting/transforming and reselling.

Money, and interest, took on a new role. The amount of interest asked was specific to each occurrence – if I trust you are a capable (of doing whatever you are trying to do) person then I’m going to ask a smaller interest from you. In the end a lender gets paid for assessing risk – at the end of the day some deals get sour, some get through, and if the risks were correctly measured – and the corresponding interests asked – the investor/lender ends up with some profit. Meanwhile the same lender does another thing: he is distributing resources among the competing entrepreneurs and so the ones that are more creditworthy can start their businesses a little easier.

This way resources are no longer allocated at the whim of a single person – the feudal lord – but by the business acumen and experience of a multitude of operators, the “free market” – theoretically a more natural, and thus more efficient, process.

As a consequence money was no longer a mere trade facilitator and a humble hoarding device but also a resources allocating tool. In a way, money (and interest) started to measure not only value but also trust, which became by itself a kind of resource.

Remember this is roughly the same time when “paper/fiat money” started to appear, at first having a gold equivalent and dispensing with it later. And ‘paper’ money have value (and are accepted as tender) only as long as people have reasons to trust the country that printed it.

But this whole line of reckoning presumes that the “efficient market hypothesis” is true – this would translate into the assumption that the risks are measured rationally and as a consequence the resources are appropriated reasonably. Not entirely true, is it? Elliot’s Wave Principle says it’s not, Nicholas Nassim Taleb says it’s not, George Soros (The New Paradigm for Financial Markets – The Credit Crisis of 2008 and What it Means) concurs and so on.

A symptom of this lack of reason is the financial effervescence that is, only now, starting to ebb out. People “foregot” that money is a second class resource (only as long as people think it is and that it has any value) and started to treat it as a first class/real one. As a consequence inflation is perceived as inherently bad and not as a normal mechanism for economic adjustment and, more importantly, people now want to obtain “money”, and lots of it, directly from “money”.

No transformation whatsoever. The cycle “money traded for resources transformed into merchandise and traded back into money” has been replaced by money conned from one hand to another. Currently, quite a lot of people are convinced they can retire with no (little) public pensions and that they’ll be able to live of the revenue (and not the capital itself) received from investing whatever small fortune they have saved (delayed consumption), or inherited.

This means that these people have to enter the “resources (trust) allocating” game, the ‘financial market. Since most of them don’t have the necessary skills they rely on others: bank or fund managers or even the CEO-s of the companies whose stock they have bought. And all these managers, under pressure, have started to (mis)use a lot of instruments, originally designed as insurance/hedging, in order to make money out of thin air (speculation).

That’s how the derivative markets became bigger than the spot market. Making an analogy we can consider speculators as some kind of carnivores whose very important role is to keep the herds in top condition by culling the misfits. The benefit of the ‘landlord’, the one who from time to time hunts himself (buys or sells stock), is that the herds (companies) are OK, don’t get degenerated and don’t overgraze. But no sane landlord, not until now at least, would consider lions’ meat (or whatever else might be obtained from them) as a desirable food but only hunts (gets involved with paper issued by highly speculative investment funds) them for sport or when they threaten the well being of the herds. So why am I not surprised by the last moves in the world of investment banking? Or even banking in general?

2021 edit.

Some people still have a hard time understanding how Trump had come to be.

I was speaking above about those money managers hard pressed to produce yield.

Some of them had fulfilled their task by exporting ‘real’ jobs to places where the work force was cheaper. And/or by replacing people with robots.

This development has deepened the divide between the haves and the have nots.

Those who had happened to have some invested capital at the start of the process only got richer.

Those who didn’t had found that getting richer was way harder than for their parents. Education had become way more expensive while the good paying jobs were no longer available.

Trump had promised to bring back those jobs. And to ‘ease’ the tax ‘burden’.

By doing this he was able to endear himself to people competing for the same thing. Money. Mere money….

To those people convinced that having money is enough.

That mere possesion of money can get you there. No matter where that ‘there’ might be…

To put it briefly, Trump – and his followers, ignore the fact that money is, by definition, a convention.

A convention which is based on trust. On mutual trust between the members of the society.

On the trust that when push will come to shove, each of us will do what is expected of them.

What the community, as a whole, will need them to do.

You see, what Trump – and his followers, seem to ignore is the fact that no individual – no matter how rich/powerful/skilful/bright, can survive, sustainably, on their own. And even less ‘against the grain’.

What many of Trumps detractors ignore is the corespondent fact. That no community will survive sustainably if it is reduced to a herd. That only a community composed of autonomous – also known as ‘free’, individuals have a fighting changes at being flexible enough to survive indefinitely.

The problem being that people chasing money as the ultimate goal are not free.

Are not free to pursue alternative goals. To explore.

They are so mesmerized that are behaving like moths lured to a flame.

2022 edit

It just downed on me that until recently money have been used by the powerful to maintain their power.

Kings minted coins to pay their armies and to feed their people.

Governments printed money to pay for whatever was needed so that the society kept going.

Nowadays those in power use their positions to hoard money.

Accept bribes. Use their connections to arrange deals. To promote legislation. For a ‘fee’, of course!

[…] wrote this some five years ago trying to argue that money is nothing but an instrument and that we […]

LikeLike

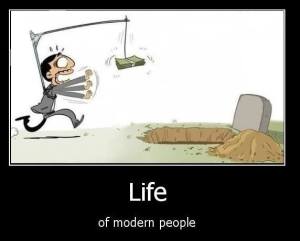

Found this picture and can’t resist sharing it with you:

LikeLike

LikeLike

http://www.forbes.com/sites/stevedenning/2013/05/28/how-hedge-funds-transfer-wealth-from-investors-to-managers/

LikeLike

[…] What is money, instrument or goal? […]

LikeLike

[…] Daca stam bine sa ne gandim invazia de gunoi provine in mare parte din ‘bucuria’ cu care consumam. Cei care vand incearca sa ne convinga sa cumparam cat mai mult pentru ca ei sa aibe castiguri cat mai mari iar noi cumparam mai multe lucruri decat avem cu adevarat nevoie tocmai pentru ca acest lucru ne creeaza o ciudata stare de bine. Pana la urma toate acestea au o foarte puternica legatura cu obsesia noastra pentru bani. […]

LikeLike

http://www.rawstory.com/2015/09/ex-hedge-funder-buys-rights-aids-drug-and-raises-price-from-13-50-to-750-per-pill/comments/#disqus

LikeLike

LikeLike

And this is how science has been crippled by our obsession for money:

http://chronicle.com/article/The-Water-Next-Time-Professor/235136/#st_refDomain=www.facebook.com&st_refQuery=

LikeLike

“reasons ranging from manufacturing problems to federal safety crackdowns to drugmakers abandoning low-profit products.”

Just another example of what happens when the “mere” ownership of money is seen as the ultimate goal…

LikeLike

Still counting on ‘the trickle down effect’ to raise the economy?

“U.S. employers continue to hold the line on wages despite six years of economic recovery and an unemployment rate of 5%. Finance chiefs are “probably looking ahead and saying they want to keep the escalation of labor costs from going up in a way that will put pressure on earnings,” said Ajit Kambil, global research director of Deloitte’s CFO Program.

In Deloitte’s most recent quarterly survey, 47% of chief financial offers said they plan to work to lower or control labor costs this year, by taming compensation growth, reducing benefit costs or other means. Moreover, employers may feel they can lowball applicants because they believe there is still a surplus of qualified candidates.

“Workers are still a little discounted” in most fields, said Linda Barrington, executive director of the Institute for Compensation Studies at Cornell University’s ILR School. “Employers won’t pay what the last person in the job was paid because labor is now on sale.””

http://www.wsj.com/articles/high-salaries-haunt-some-job-hunters-1454634475

LikeLike

“Turing and Valeant have turned the entire biotech and pharma model of research & development investment on its head. Instead of embarking on traditional drug development, involving hundreds of millions of dollars in research and development, Turing and Valeant bought up companies with cheap drugs and significantly raised their prices.

After Turing paid $55 million to acquire the anti-parasitic drug Daraprim — which is also used to treat HIV — it raised its price more than fifty-fold to $750 per pill. And Valeant’s controversial serial acquisitions were based on a strategy of pushing up prices of the acquired rugs. On May 21, Valeant interim CEO Howard Schiller, who was CFO at the time, wrote in an e-mail that about 80 percent of sales growth in the first quarter came through price increases, according to the congressional memo.”

http://finance.yahoo.com/news/drug-pricing-161315534.html#

LikeLike

[…] – m-am intrebat ‘si dracu’ o sa fac daca incepe un razboi?’ Uite ca obsesia generalizata pentru bani – la care contribuim, de fapt, cu totii – poate produce ‘neplaceri’ si in […]

LikeLike

[…] because money have proved, over the centuries, to be very reliable tools? Because profit has been a very good measure for a company’s ability to survive? If […]

LikeLike

[…] only problem with the third option being our current obsession with money. For as long as we’ll let ourselves be governed by the current mantra, “greed is […]

LikeLike

[…] Not only because some of the participants have become ‘heavy’ enough to crush all competition. This is only the lesser part of the problem. The really big one, and so well hidden that it’s almost invisible, is that too many of us have become obsessed with money. […]

LikeLike

[…] further consideration, money can be understood as a tool with many uses. Hoarding, for instance. Bananas, among other things […]

LikeLike

https://www.npr.org/sections/money/2019/08/27/754323652/the-strange-unduly-neglected-prophet

LikeLike

[…] https://nicichiarasa.com/2013/10/08/money-instrument-or-goal/ […]

LikeLike

“For a fee”…

https://www.theguardian.com/news/2022/jul/10/uber-files-leak-reveals-global-lobbying-campaign

LikeLike